Debt collecting can be a scary thing, especially if you’re new to business admin and financial management. This is why it’s important to set the precedent with your customers from the very beginning. Showing consistency when chasing your debtors will help to ensure you are maintaining good customer relationships while also recovering your debts. Don’t wait for your cash flow to stop, instead, contact customers quickly about their overdue invoices or never-ending accounts. Depending on what their payment terms are – whether you’ve set a 7 day, 30 day or other payment period – begin following up with your debtors the day it becomes overdue. This way, if your customers are having trouble with their cash flow they’ll know to pay your invoice before others as you’ve set the correct precedent. They’ll know they need to adhere to the financial commitments they’ve made with you and your business.

Where to begin?

The Queensland Government recommends the following steps when chasing your overdue payments:

- Send a statement requesting payment and indicating this is a reminder or final notice.

- Telephone the customer and remind them to pay the debt. Ask them if there is a problem. If they offer no reason, ask them to settle the debt by a specific date.

- If there is a cash flow problem, try to arrange a payment plan that suits both you and the customer.

- If the debt is not settled within the agreed time, you may want to consider mediation, debtor finance or debt collection services.

Legal action is very expensive and should be considered as a last resort. Please note legal requirements and procedures vary from state to state and country to country.

Let COSTAR help

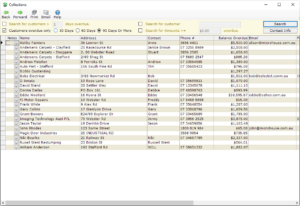

COSTAR‘s collection function is used to identify overdue Accounts Receivable Customers and Invoices. You may search for customers > “X” days overdue; customers overdue by 30, 60, 90 Days or More; by a specific customer or overdue by > = “X” dollars. You may also search by a combination of these. An example might be searching for Customers 90 Days or More with outstanding amount > = to $5000.00.

It’s likely that once you send a message or call your customers when chasing their debts, they’ll come back with questions. What’s handy is you have all the information of their account at your fingertips. You can have at the ready their entire statement, each invoice with details of which car was serviced and the exact work performed on that vehicle, along with any notes you’ve made i.e. Bethany on 13/09/19 said it would be paid by next Wednesday.

The “Notes” function is used for recording collection details and the next follow-up date, as pertains to the “Customer.” It’s best practice to record these notes at the customer level not invoice level in COSTAR Collections screen as it allows you to see them over time and you are then able to make informed business decisions. If this customer is constantly late with their payments, you can remove their credits or shorten the billing period from 30 days to 7 days. We recommend chasing the big fish first with the larger amounts owing as they will make the biggest splash to your cash flow.

Being proactive with chasing debts puts you back in control as you have the answers you need when customers hit you with tricky and awkward questions, all the information is there waiting for you.

This is the tool for you, buckle up and go get em!

If you have any questions, please don’t hesitate to get in touch with our Support team!