The cost to open the door each morning…a metric commonly overlooked by small – medium businesses. Haven’t heard of it? The term comes from a business knowing its break-even point or “cost to open the door each morning” before a single sale is made (basically all the expenses and outgoings a business incurs before it has even started selling). This may include rent, wages, insurance, registration, loan repayments etc.

COSTAR Sales Analysis Solution

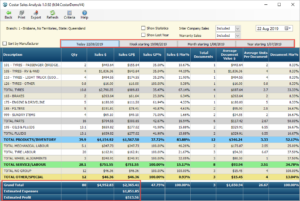

The good news is, COSTAR’s Sales Analysis has a wealth of useful information, divided across four categories (Daily, Weekly to Date, Monthly to Date or Annual to Date). The screen can add a monthly “Estimated Expenses” figure that converts to a daily estimated expense, so when looking at the sales you’ll know if you’ve passed the “cost to open the door each morning” figure and are making a profit. Additionally, when on the week, month or year tabs of the Sales Analysis screen, it calculates how many days that is and accumulates the Estimated Expenses. Some owners bump the figure up to motivate their store managers. You can even add in a manufacturer breakdown which will help identify your Share of Business (keep an eye out for a blog post on this in the future).

Setting Realistic Expectations

If you can identify and plan for these costs, it means you can avoid as many surprises as possible. Knowing this vital information will allow you to consider the time in which it will take you to generate enough revenue to cover your expenses. It has even been recommended by experts to overestimate, meaning you add 10% on top of your total costs to act almost like insurance for any hiccups you may incur in the coming weeks, months and year.

Budgets

You can display an Estimate Expenses line in your Sales Analysis window. This amount will display proportionally depending on which view you have selected (Daily, Weekly to Date, Monthly to Date or Annual to Date). It can be used as an indication that the value of your Sales has covered your Estimated Expenses for any given period.

Remember, the Estimated Expenses should be calculated external to COSTAR and may include items such as wages, rent, electricity, loans etc. You could calculate these on an annual basis based on the previous 12 months to get a monthly average value. Alternatively, you could calculate your daily expenses based on the previous year’s trading and add that to the Daily Expense column. You can also allow for additional and unusual expenses in a month (you might have an annual expense in a particular month that makes it extraordinary).

Leveraging this data to make well-informed decisions about your business has never been easier. Having a clear-cut understanding of your business expenses and break-even point means you’ll be equipped with the knowledge to make smart and tailored decisions for a healthy bank account and healthy business.

As always, if you have any further questions or would like a hand to implement this into your business, please contact our Support team.